ABLE Accounts and Individuals With Disabilities

Congress created Achieving Better Life Experience (ABLE) accounts in 2014. Prior to the creation of the ABLE accounts, individuals with disabilities who were eligible for Medicaid or federal Supplemental Security Income were limited to a maximum of $2,000 in assets, such as bank savings accounts. Now, disabled people are allowed to have up to $100,000 in one of these special accounts without jeopardizing their Medicaid or Supplemental Security Income.

ABLE accounts are available to individuals who became disabled before the age of 26. Once an account is established, anyone can contribute to it, provided that the sum of the contributions for the year does not exceed the annual gift tax exclusion, which is currently $16,000. These accounts are a less-expensive substitute for special needs trusts, which have significant administration costs. If contributions will exceed the annual gifting limit and $100,000 overall, a special needs trust will be required.

Each state must enact its own legislation to make ABLE accounts available in that particular state. As of August, 2022, only four states (Idaho, North Dakota, South Dakota, and Wisconsin) haven’t established ABLE programs. Even so, many states allow nonresidents to participate in their program, while some states only allow their own residents to participate in their ABLE account program.

ABLE accounts are fashioned after qualified state tuition programs, sometimes referred to as Section 529 plans. Although there is no tax benefit associated with contributions to the accounts, the earnings in the accounts accumulate tax-free and are also tax-free if used for qualified expenses such as:

Health care,

Education,

Employment training and support,

Assistive technology,

Personal support services,

Housing, and

Transportation expenses.

As a note of caution, qualified expenses do not include food, entertainment or vacations.

Only one account can be established for each beneficiary. The maximum annual contribution to an ABLE account is equal to the annual gift tax exemption amount, which for 2022 is $16,000.

Certain ABLE account beneficiaries who are employed may make an additional contribution to their ABLE account up to the lesser of:

The account beneficiary's compensation for the tax year, or

The poverty line for a one-person household. For 2022, this amount is $12,880 in the continental U.S., $16,090 in Alaska, and $14,820 in Hawaii.

Working ABLE account beneficiaries will only be able to take advantage of making additional contributions to their accounts through 2025.

ABLE accounts are designed so that certain employed ABLE account beneficiaries may be eligible to claim the nonrefundable saver's credit for a percentage of their contribution. To claim the saver's credit, an individual must:

Be at least 18 years old at the end of the tax year

Not be a dependent or a full-time student, and

Meet the income requirements.

The saver's credit is phased out for higher income taxpayers.

Families of a person with a disability may roll over funds from a 529 plan to the individual's ABLE account. Such rollovers count toward the annual contribution limit. For example, the $16,000 annual contribution limit would be met by parents contributing $10,000 to their child's ABLE account and rolling over $6,000 from a 529 plan to the same ABLE account.

If you have questions related to ABLE account contributions, the saver’s credit, or rollovers from qualified tuition plans, please call your local tax office.

Health Savings Accounts Fill Multiple Tax Needs

The Health Savings Account (HSA) is one of the most misunderstood and underused benefits in the Internal Revenue Code. Congress created HSAs as a way for individuals with high-deductible health plans (HDHPs) to save for medical expenses that are not covered by insurance due to the high-deductible provisions of their insurance coverage.

However, an HSA can act as more than just a vehicle to pay medical expenses; it can also serve as a retirement account. For some taxpayers who have maxed out their retirement-plan options an HSA provides them another resource for retirement savings – one that isn’t limited by income restrictions in the way that IRA contributions sometimes are.

Although the tax code refers to these plans as “health” savings accounts, they can also be used for retirement, as there is no requirement that the funds be used to pay medical expenses. Thus, a taxpayer can pay medical expenses with other funds, thus allowing the HSA to grow (through account earnings and further tax-deductible contributions) until retirement. In addition, should the need arise, the taxpayer can still take tax-free distributions from the HSA to pay medical expenses.

Withdrawals from an HSA that aren’t used for medical expenses are taxable and – depending on the taxpayer’s age – can be subject to penalty. Once a taxpayer has reached age 65, nonmedical distributions are taxable but not subject to a penalty (the same as for a traditional IRA once the IRA owner reaches age 59½). At the same time, regardless of age, a taxpayer can always take tax-free distributions to pay medical expenses.

Example: Henry is age 70 and has an HSA account from which he withdraws $10,000 during the year. He also has unreimbursed medical expenses of $4,000. Of his $10,000 withdrawal, $6,000 ($10,000 – $4,000) is added to Henry’s income for the year, and the other $4,000 is tax-free.

Eligible Individual – To be eligible for an HSA in a given month, an individual:

1. must be covered under a HDHP on the first day of the month;

2. must NOT also be covered by any other health plan (although there are some exceptions);

3. must NOT be entitled to Medicare benefits (i.e., generally must be younger than age 65); and

4. must NOT be claimed as a dependent on someone else’s return.

Any eligible individual – whether employed, unemployed or self-employed – can contribute to an HSA. Unlike with an IRA, there is no requirement that the individual have compensation, and there are no phase-out rules for high-income taxpayers. If an HSA is established by an employer, then the employee and/or the employer can contribute. Family members or any other person can also make contributions to HSAs on behalf of eligible individuals. Both employer contributions and employee contributions made via the employer’s cafeteria plan are excluded from the employee’s wage income. Employees who make HSA contributions outside of their employers’ arrangements are eligible to take above-the-line deductions – that is, they don’t need to itemize deductions – for those contributions.

The Monetary Qualifications for a HDHP –

Example – Family Plan Does Not Qualify: Joe has purchased a medical-insurance plan for himself and his family. The plan pays the covered medical expenses of any member of Joe’s family if that family member has incurred covered medical expenses of over $1,000 during the year, even if the family as a whole has not incurred medical expenses of over $2,800 during that year. Thus, if Joe’s medical expenses are $1,500 during the year, the plan would pay $500. This plan does not qualify as a HDHP because it provides family coverage with an annual deductible of less than $2,800.

Example – Family Plan Qualifies: If the coverage for Joe and his family from the example above included a $5,000 family deductible and provided payments for covered medical expenses only if any member of Joe’s family incurred over $2,800 of expenses, the plan would then qualify as a HDHP.

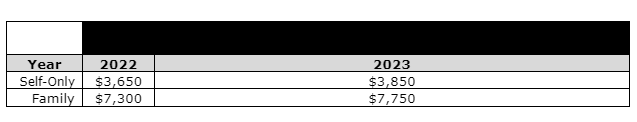

Maximum Contribution Amounts – The amounts that can be contributed are determined on a monthly basis and are calculated by dividing the annual amounts shown below by 12. Thus, if an individual’s health plan only qualified that person for an HSA for 6 months out of the year, then that person’s contribution amount would be half of the amount shown.

In addition to the amounts shown, an eligible individual who is age 55 and older can contribute an additional $1,000 per year.

How HSAs Are Established – An eligible individual can establish one or more HSAs via a qualified HSA trustee or custodian (an insurance company, bank, or similar financial institution) in much the same way that an individual would establish an IRA. No permission or authorization from the IRS is required. The individual also is not required to have earned income. If employed, any eligible individual can establish an HSA, either with or without the employer’s involvement. Joint HSAs between a husband and wife are not allowed, however; each spouse must have a separate HSA (and only if eligible).

If you have questions related to how an HSA could improve your long-term retirement planning or health coverage, please call your tax advisor.

What Is an Offer in Compromise?

Carrying long-term debt is a challenge, but when the money is owed to the government and you see no way to pay what you owe, it can be psychologically and emotionally debilitating. Some people think they can turn to bankruptcy, but that is not the case – bankruptcy specifically will not discharge tax debts. One of the few options available for settling tax debt is an IRS program called an Offer in Compromise, or OIC.

An OIC is not something that the IRS agrees to lightly. Roughly one in three applications for the program are approved. Still, it may be worth your time and effort to determine whether you qualify.

The Three Steps to Applying for an Offer in Compromise

Fill out IRS form 433-A and IRS form 656. If you plan to appeal the debt itself, you will also need to fill out IRS form 656-L.

Pay the nonrefundable application fee of $205. If your income is below the IRS low-income guidelines, the fee may be waived.

Propose paying an alternative amount to the IRS

This is a simple summary of a complex process that requires providing a significant amount of detail about your income and expenses. Though the form asks for a lot of information, the more diligent you are in demonstrating your inability to pay both your bills and your tax debt, the better your chances of being approved. It is also notable that 20% of the amount that you are offering to pay within your application must be included with your application in order for it to be considered. If your Offer in Compromise is rejected, the money will be applied toward your debt.

Eligibility for Applying for an OIC

Qualifying for an OIC is difficult in large part because the IRS has such strict rules about who is eligible to apply, as well as regarding what is needed to qualify.

Let’s look at the question of whether you can apply first. In order for your application to be accepted, you must make sure that you meet the following criteria:

You have answered all questions on the forms

You are current in having filed your tax returns

You must have submitted the $205 application fee or successfully had it waived

There must be at least one tax debt in your Offer in Compromise for which you have not received a bill

You must have submitted all of your estimated tax payments for the current year

You must not be in the midst of a bankruptcy proceeding

You must continue paying taxes and filing your tax returns while the IRS response to your offer is pending

Your case cannot have been sent to the Justice Department by the IRS

If any of these items are not in evidence, the IRS will send your application back for correction and resubmission.

Qualifying for an Offer in Compromise

The decision-making process that the IRS uses when considering taxpayers’ Offers in Compromise is an objective calculation, based on the financial information that’s been submitted to them, about whether and how much payment they are likely to be able to recover – a number referred to as “Reasonable Collection Potential.” That financial information considered includes all of your assets, your income, and your earnings potential as well as your cost of living and your debts. The IRS is extremely granular in their analysis, working to determine whether the amount of payment that you have suggested in your Offer in Compromise is less than, equal to, or greater than the Reasonable Collection Potential.

When the IRS accepts an Offer in Compromise, it is generally because they agree that your circumstances make it a hardship for you to pay, because there is a question about the actual amount that you owe, or because they believe that they’re never going to be able to collect the amount that you owe in full.

What the IRS Offer May Look Like

If the IRS decides to grant your request for an Offer in Compromise, they will do so in one of two ways. You will either be able to pay your debt off within five months or under a 24-month payment plan.

It is important to remember that under either of these plans, the IRS will already have received 20% of your offer amount and it will be considered the first payment under either of these payment options.

What Happens While You’re Waiting for the IRS to Respond

Upon receipt of your Offer in Compromise and all supporting documentation, all IRS collection activities will cease. If there are tax liens in place they will remain in place pending a decision and until you have made all payments if your offer is accepted. You will continue receiving any tax refunds that you are owed unless it is received via an amended return after an Offer in Compromise has been activated.

If your tax refund has been garnished and you are waiting for an IRS response to your Offer in Compromise proposal, you can request an offset bypass refund based on economic hardship that you will have to prove.

Rejection of your Offer in Compromise is appealable, and there are other options available — including installment plans or a “currently not collectible” status that can help you relieve extreme financial stress.

If you are struggling with tax debt that you believe you will simply be unable to pay, an Offer in Compromise may be the answer. For help identifying the best option available for your specific circumstances, contact your tax advisor!

Tax Relief for Victims of Hurricane Ian

The Federal government provides special tax law provisions to help taxpayers and businesses recover financially from the impact of a disaster, especially when the federal government declares their location to be a major disaster area as they have for Hurricane Ian. The following highlights the special tax provisions:

Filing Due Dates Affected –

October 17, 2022 – Is the extended due date for 2021 returns that are on a valid extension. This means individuals who had a valid extension to file their 2021 return due to run out on October 17, 2022, will now have until February 15, 2023, to file. However, because tax payments related to these 2021 returns were due on April 18, 2022, those payments are not eligible for this relief and late payment penalties will apply to any tax due on the return.

January 17, 2023 – Is the filing due date for the 4th quarter estimated tax payment which now is not due until February 15, 2023.

The February 15, 2023, deadline also applies to:

Quarterly payroll and excise tax returns normally due on October 31, 2022, and January 31, 2023.

Businesses with an original or extended due date also have the additional time including, among others, calendar-year corporations whose 2021 extensions run out on October 17, 2022. Similarly, tax-exempt organizations also have the additional time, including for 2021 calendar-year returns with extensions due to run out on November 15, 2022.

In addition, penalties on payroll and excise tax deposits due on or after Sept. 23, 2022, and before Oct. 10, 2022, will be abated as long as the deposits are made by Oct. 10, 2022.

Option as When to Declare the Disaster Loss – The IRS allows both individuals and businesses in a federally declared disaster to claim a disaster loss in either the current tax year or the previous tax year. Claiming the loss in the prior year allows taxpayers to get a faster tax refund for the disaster loss. So hurricane Ian losses can be claimed on either:

The 2022 return or

The 2021 return by amending an already filed 2021 return or the unfiled 2021 that is currently on extension through October 17, 2022. That extension has been extended through February 15, 2023, as part of the disaster relief.

However, careful consideration should be given to which year’s return will provide the greater tax benefit. Also, consider that claiming the loss on the 2021 where there would otherwise be a tax due can reduce or eliminate any late payment penalties.

Be sure to write the FEMA declaration number – DR-4673-FL − on any return claiming a loss. See Publication 547 for details.

The IRS disaster relief page has details on other returns, payments and tax-related actions qualifying for the additional time.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. Therefore, taxpayers do not need to contact the agency to get this relief. However, if an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date falling within the postponement period, the taxpayer should call the number on the notice to have the penalty abated.

In addition, the IRS will work with any taxpayer who lives outside the disaster area but whose records necessary to meet a deadline occurring during the postponement period are in the affected area. Taxpayers qualifying for relief who live outside the disaster area need to contact the IRS at 866-562-5227. This also includes workers assisting the relief activities who are affiliated with a recognized government or philanthropic organization.

The tax relief is part of a coordinated federal response to the damage caused by Hurricane Ian and is based on local damage assessments by FEMA. For information on disaster recovery, visit DisasterAssistance.gov.

Similar provisions apply to other disaster areas. Here are some recent areas:

California Wildfires - With the extension date being January 3, 2023. FEMA declaration number - FEMA-4610-DR.

Puerto Rico and Hurricane Fiona - With the extension date being February 15, 2023. FEMA declaration number - EM-3583-PR.

Alaska - Victims of storms and flooding that began on September 15, 2022. Filings extended until February 15, 2023. FEMA declaration number - DR-4672-AK.

For questions related to disaster tax issues please give your tax professional a call today!

Maximizing Your Airbnb Rental Income

If you list your property on Airbnb, you know it has been a remarkable boon for property owners looking to earn income from their available space. The online marketplace makes it easy for you, offering free listings and the ability to set your own price while also offering Host Damage Protection and shouldering the payment process. But for all of the success that hosts worldwide have realized, there have also been frustrations. Some hosts have been disappointed by their earnings and disgruntled by the tax ramifications of their rental income. There are actions you can take – both big and small – to maximize your Airbnb rental income. Likewise, you can take steps to reduce your tax obligation. Let’s take a look at both.

Boosting Your Airbnb Revenue

Though the money you make by listing your property on Airbnb is referred to as passive income, it is the listings whose owners put in the most effort who make the most money. While offering a property in a convenient or desirable location may be enough to bring people in, there are steps you can take that will make your space more attractive and generate more positive reviews. This in turn will keep your property booked and allow you to raise your rates. Try these strategies:

Make sure that your space looks its best when you’re taking photos and that you’ve used positive, descriptive language to describe your property.

Take the time to understand who is renting your property and cater to their needs. If you’re attracting beachgoers be sure to provide colorful, plush towels and beach chairs. Families with children will appreciate books, toys, and video games, and business travelers will be quick to rent a spot that has a dedicated work area.

Compare your rates to those of successful listings in your area to make sure that they are in line.

Small amenities make a big difference. Leaving a bag of coffee grounds on the counter, a loaf of bread, and a dozen eggs in the refrigerator are a small touch that goes a long way. Similarly, putting out curated soaps or shampoos costs little, but will result in enthusiastic positive reviews that will attract more guests, and may allow you to increase your price to more than cover the small cost incurred.

Optimize Your Rental Income Taxes

The revenue that you take in from renting your property is a form of self-employment, and anything over $1,000 earned in a year is subject to quarterly estimated income tax. These payments are required unless you qualify for the “14-day rule,” which holds that if you rent your property for less than 14 days per year and you use it yourself for more than 14 days per year, there is no reporting requirement, no matter how much you’ve charged. Estimating the taxes you owe each quarter can be based on the previous year’s income – and if it’s your first year as a host the IRS allows you to use your W-2 income. You’ll also need to pay self-employment taxes, and all tolled it can be a big out-of-pocket hit that makes you wonder whether the venture was worth your while.

The good news is that the taxes you pay on your rental income can be offset by the many deductions you’re entitled to take. These may include:

The cost of any improvements or repairs that you make to your property, including furnishings, linens,

The cost of providing internet or cable services for your guests, as well as any subscription services like Netflix, Hulu, or Disney

The cost of having your property professionally cleaned and maintained

The cost of any supplies that you use to clean or maintain the property yourself

Depreciation on the property

Fees that you pay to Airbnb

The mortgage interest paid on the property, as well as property insurance if it is not your primary home

To make sure that you’re getting the most out of your property rental and optimizing your rental income, contact your tax advisor’s office today.

Tax Benefits for Members of the Military

Military members benefit from a variety of special tax benefits. These include certain non-taxable allowances, non-taxable combat pay, and a variety of other special tax provisions. Here is a rundown on the most prominent of the tax benefits.

Service Member Residence or Domicile – A frequent question by service members is “What is my state of residence for tax purposes?” since one’s duty station may change multiple times while serving. Luckily, the government passed a law to solve this issue. A service member continues to retain his or her home state of residence for tax purposes, even when required to move to another state under military orders. This also applies to other tax jurisdictions within a state, such as for city, county, and personal property taxes. Thus, a service member will continue to file tax returns for his or her home state and not the state where he or she is stationed.

Service Member Spouse’s Residence or Domicile – Thanks to the Veterans Benefits and Transaction Act of 2018, an individual married to a military member now has more choices. Under the act, a spouse can elect to have the same state of domicile as their service member spouse, even if they didn’t previously have the same domicile. If the non-military spouse doesn’t make that election, they can continue to choose to file in their own domicile state.

Making these choices can significantly impact the amount of state tax the spouse might have to pay. As an example, a spouse of a service member stationed in a high-income-tax state can elect to use the state of residency of the service member whose residence state has no or low state income tax and not be subject to the state taxes where his or her spouse is stationed.

Careful – It is tempting for a service member or their military spouse to declare their state of domicile to be without any state income tax such as Texas, Nevada, Florida, etc. That can get them in hot water if they do so without any connections to the state.

Non-Taxable Allowances – Members of the military benefit from a number of non-taxable allowances including:

Living allowances - Basic allowance for housing (BAH), housing and cost-of-living allowances abroad whether paid by the U.S. Government or by a foreign government and overseas housing allowance.

Family allowances - Certain educational expenses for dependents, emergencies, evacuation to a place of safety and separation.

Death allowances - Burial services, death gratuity payments to eligible survivors, and travel of dependents to burial sites.

Moving allowances – Including for relocation, move-in housing, moving household and personal items, moving trailers or mobile homes, storage, temporary lodging and temporary lodging expenses, and military base realignment and closure benefits.

Travel allowances – Including annual round trips for dependent students, leave between consecutive overseas tours, reassignment in a dependent-restricted status, transportation for military taxpayers and dependents during ship overhaul or inactivation, and per diem.

State benefit payments – Any bonus payment made by a state or political subdivision to any member or former member of the U.S. uniformed services, or to his or her dependent, only because of the member's service in a “combat zone,” is generally treated as a “qualified military benefit” excludable from gross income.

Other payments – Defense counseling, disability (including payments received for injuries incurred as a direct result of a terrorist or military action), group term life insurance, professional education, ROTC educational and subsistence allowances, survivor and retirement protection plan premiums, uniform allowances, and uniforms furnished to enlisted personnel.

In-kind military benefits – Including legal assistance benefits, space-available travel on government aircraft, medical/dental care, and commissary/exchange discounts.

Combat Zone Exclusion – A member of the U.S. Armed Forces who serves in a combat zone can exclude certain pay from income. This pay includes active duty pay earned in any month served in a combat zone; imminent danger/hostile fire pay; a reenlistment bonus, if the voluntary extension or reenlistment occurs during a month served in a combat zone; accrued leave pay earned in any month served in a combat zone; awards for suggestions, inventions, or scientific achievements the service member is entitled to because of a submission made in a month served in a combat zone; and student loan repayments attributable to the period of service in a combat zone (provided a full year’s service is performed to earn the repayment).

Any part of a month in a combat zone counts as an entire month. Periods when one is hospitalized as the result of wounds, disease, or injury in a combat zone are also excluded, provided the hospitalization begins within 2 years of combat zone activities. The hospitalization need not be in the combat zone. Generally, the excludable combat pay is not included in the individual’s pay reported on Form W-2.

Commissioned Officers – Commissioned officers may exclude their pay; however, the amount of their exclusion is limited to the highest rate of enlisted pay (plus imminent danger/hostile fire pay received).

Home Mortgage Interest Deduction – Military taxpayers who receive a non-taxable housing allowance and also own a home can deduct the mortgage interest on their home as an itemized deduction, even if they are paid with the non-taxable military housing allowance pay. However, the home mortgage interest is still subject to the general rules for deducting home mortgage interest, meaning through 2025, only home acquisition debt interest is deductible. Home acquisition debt is debt used to acquire, build, or substantially improve a home.

Home Property Tax Deduction – Even though they receive a non-taxable housing allowance, a military taxpayer can still deduct their home’s property taxes as an itemized deduction. However, the the deduction for real property tax and state/local income or sales tax is limited to $10,000 annually for years 2018 through 2025.

Home Sale Gain Exclusion – Most taxpayers can exclude up to $250,000 ($500,000 if filing married joint) of home gain if the home was owned and used as their main home for 2 of the 5 years preceding its sale. However, a military taxpayer may choose to suspend the 5-year test period for ownership and use during any period when the taxpayer (or spouse) serves on qualified official extended duty as a member of the Armed Forces. This means that the 2-year use test may be met even if, because of military service, the taxpayer did not actually live in his or her home for at least the required 2 years during the 5-year period ending on the date of sale.

For this exception to the usual test period, a taxpayer is on qualified official extended duty when at a duty station that is at least 50 miles from his or her main home, or while residing under orders in government housing for more than 90 days or for an indefinite period.

The suspension period cannot last more than 10 years and can be revoked by the taxpayer at any time. The 5-year period cannot be suspended for more than one property at a time.

Example – Sarge bought and moved into a home in 2014 that he lived in as his main home for 2½ years. For the next 6 years, he did not live in the home because he was on qualified official extended duty with the Army. He sold the home for a gain in 2022. To meet the use test, Sarge chooses to suspend the 5-year test period for the 6 years he was on qualifying official extended duty – he disregards those 6 years. Sarge’s 5-year test period consists of the 5 years before he went on qualifying official extended duty. He meets the ownership and use tests because he owned and lived in the home for 2½ years during this test period.

Moving Expenses Deduction – The moving expenses deduction for all moves, except for certain members of the Armed Forces, is not allowed for years 2018 through 2025. Military taxpayers may still claim a moving expenses deduction if they are required to move because of a permanent change of station. However, the deduction is limited to the actual cost less any non-taxable moving allowance provided.

A permanent change of station includes (1) a move from home to one’s first post of duty when appointed, reappointed, reinstated, called to active duty, enlisted or inducted; (2) a move from one permanent post of duty to another permanent post of duty at a different duty station, even if the service member separates from the Armed Forces immediately or shortly after the move; and (3) a move from one’s last post of duty to home or to a nearer point in the U.S. in connection with retirement, discharge, resignation, separation under honorable conditions, transfer, relief from active duty, temporary disability retirement, or transfer to a fleet reserve, if the move occurs generally within 1 year of ending active duty or within the period allowed under the Joint Travel Regulations.

Death Gratuity Payments – Military death gratuity payments and amounts received under the service members' group life insurance program are not taxable to eligible survivors. In addition, these amounts may be rolled over to a Roth IRA or Coverdell education savings account without regard to the limits that otherwise apply to other taxpayers.

Child Credit – Excluded combat pay is treated as earned income for purposes of determining the refundable portion of the child credit.

Earned Income Tax Credit (EITC) – A taxpayer may elect to treat combat pay that is otherwise excluded from gross income as earned income for purposes of the EITC. Making this election for EITC purposes may or may not be advantageous. If the taxpayer has earned income below the maximum amount of earned income on which the credit is calculated, including the combat pay will increase the credit amount. On the other hand, if the taxpayer’s earned income is already in the phase-out range, electing to include combat pay as earned income will decrease the amount of credit that can be claimed.

IRA Contributions – For 2022, individuals can contribute up to $6,000 ($7,000 if age 50 or over) to their IRA accounts, subject to phase-out limits for certain higher-income individuals. However, any contribution is limited to the individual’s earned income for the year. For service members, their combat pay, even though it is not taxable, is treated as earned income for purposes of an IRA contribution.

Reservist’s Travel Expenses - Armed Forces reservists who travel more than 100 miles away from home and stay overnight in connection with service as a member of a reserve component can deduct travel expenses as an adjustment to gross income. Thus, this deduction can be taken even by taxpayers using the standard deduction. However, the expenses themselves are subject to certain limitations. Transportation, meals (subject to a 50% limit unless in 2021 or 2022 the meal is provided by a restaurant) and lodging qualify, but the deduction is limited to the amount the federal government pays its employees for travel expenses, i.e., the general federal government per diem rate for lodging, meals and incidental expenses applicable to the locale and the standard mileage rate for car expenses plus parking and ferry fees and tolls.

Qualified Reservists Early Retirement Plan Withdrawals - Qualified reservists are permitted penalty-free withdrawal from IRAs, 401(k)s and other arrangements if ordered or called to active duty.

A “qualified reservist distribution” is any distribution to an individual if the individual was, by reason of his being a member of a “reserve component”, ordered or called to active duty for a period in excess of 179 days, or an indefinite period and the distribution is made during the period beginning on the date of the order or call to active duty, and ending at the close of the active duty period.

Retired Military Disability Compensation – Disability compensation, as distinguished from retirement payments, are tax free and made by the Department of Veterans Affairs. Some misinformation has circulated indicating that the disability is included in the retirement benefits paid by the Defense Finance and Accounting Services. That is not true since the disability payments are made by the Department of Veterans Affairs and those amounts are NOT included on a Form 1099-R issued by the Defense Finance and Accounting Services.

Extension of Deadlines – The time limit for taking care of certain tax matters can be postponed. The deadlines for filing tax returns, paying taxes, filing claims for refund, and taking other actions with the IRS are automatically extended for qualifying members of the military.

Joint Returns – Generally, a joint return must be signed by both spouses. However, when one spouse may not be available due to military duty, a power of attorney may be used to file a joint return.

Tax Forgiveness – When members of the military lose their life in a combat zone or as the result of a terrorist action, their income taxes are forgiven for the year of their death and for any prior year that ends on or after the first day of service in a combat zone.

ROTC Students – Subsistence allowances paid to ROTC students participating in advanced training are not taxable. However, active duty pay – such as pay received during summer advanced camp – is taxable.

If you have questions related to these military tax benefits or other military tax issues, please give this office a call.

Not All Interest Is Deductible for Taxes

A frequent question that arises when borrowing money is whether or not the interest will be tax deductible. That can be a complicated question, and unfortunately not all interest an individual pays is deductible. The rules for deducting interest vary, depending on whether the loan proceeds are used for personal, investment, or business activities. Interest expense can fall into any of the following categories:

Personal interest – is not deductible. Typically this includes interest from personal credit card debt, personal car loan interest, home appliance purchases, etc.

Investment interest – this is interest paid on debt incurred to purchase investments such as land, stocks, mutual funds, etc. However, interest on debt to acquire or carry tax-free investments is not deductible at all. The annual investment interest deduction is limited to “net investment income,” which is the total taxable investment income reduced by investment expenses (other than expenses related to investments that produce non-taxable income). The investment interest deduction is only allowed to taxpayers who itemize their deductions.

Home mortgage interest – includes the interest on debt to purchase, construct or substantially improve a taxpayer’s principal home or second home. This type of loan is referred to as acquisition debt. For the interest to be deductible the debt must be secured by the home purchased, constructed, or substantially improved. A secured debt is one in which the taxpayer signs a mortgage, deed of trust, or land contract that makes their ownership in a qualified home security for payment of the debt; provides, in case of default, that the home could satisfy the debt; and is recorded under any state or local law that applies. In other words, if the taxpayer can't pay the debt, their home can then serve as payment to the lender to satisfy the debt.

For Debt Incurred Before 12/16/2017 - the debt for which the interest is deductible is limited to $1,000,000 ($500,000 for married separate).

For Debt Incurred After 12/15/2017 - the debt for which the interest is deductible is limited to $750,000 ($375,000 for married separate).

Passive activity interest – includes interest on debt that's for business or income-producing activities in which the taxpayer doesn’t “materially participate” and is generally deductible only if income from passive activities exceeds expenses from those activities. The most common passive activities are probably real estate rentals. For rental real estate activities, there is a special passive loss allowance of up to $25,000 for taxpayers who are active but not necessarily material participants in the rental. The $25,000 phases out for taxpayers with adjusted gross income between $100,000 and $150,000.

Trade or business interest – includes interest on debts that are for activities in which a taxpayer materially participates. This type of interest can generally be deducted in full as a business expense.

Because of the variety of limits imposed on interest deductions, the IRS provides special rules to allocate interest expense among the categories. These “tracing rules,” as they are called, are generally based on the use of the loan proceeds. Thus interest expense on a debt is allocated in the same manner as the allocation of the debt to which the interest expense relates. Debt is allocated by tracing disbursements of the debt proceeds to specific expenditures, i.e., “follow the money.”

These tracing rules, combined with the restrictions associated with the various categories of interest, can create some unexpected results. Here are some examples:

Example 1: A taxpayer takes out a loan secured by his rental property and uses the proceeds to refinance the rental loan and buy a car for personal use. The taxpayer must allocate interest expense on the loan between rental interest and personal interest for the purchase of the car, and even though the loan is secured by the business property, the personal loan interest portion is not deductible.

Example 2: The taxpayer borrows $50,000 secured by his home to be used in his consulting business. He deposits the $50,000 into a checking account he only uses for his business. Since he can trace the use of the funds to his business, he can deduct the interest as a business expense.

Example 3: The taxpayer owns a rental property free and clear and wants to purchase a home to use as his personal residence. He obtains a loan on the rental to purchase the home. Under the tracing rules, the taxpayer must trace the use of the funds to their use, and as the debt was not used to acquire the rental, the interest on the loan cannot be deducted as rental interest. The funds can be traced to the purchase of the taxpayer’s home. However, for interest to be deductible as home mortgage interest, the debt must be secured by the home, which it is not. Result: the interest is not deductible anywhere.

As you can see, it is very important to plan your financing moves carefully, especially when equity in one asset is being used to acquire another. Please contact your tax advisor for assistance in applying the various interest limitations and tracing rules to ensure you don’t inadvertently get some unexpected results.

Even if You’re Not Required to File a Tax Return, You May Be Missing Out if You Don’t!

Some people may choose not to file a tax return because they didn't earn enough money to be required to file, but these folks may miss out on getting a refund if they don’t file. Although there are some exceptions, generally individuals are not required to file a tax return if their income for the year is below the filing threshold for their filing status as shown in the following table.

Many social benefits provided by the government for lower income individuals are distributed through the tax return, often in the form of a tax credit, and a return must be filed to claim those benefits, many of which can be substantial. Some of these credits are partially or fully refundable even if an individual has no tax liability. So, even though you might not be required to file a return you may be missing out on a tax refund if you don’t file one. Here are some examples:

Withholding – If you are not required to file a tax return but had income taxes withheld from your W-2 wages, Social Security benefits, retirement income, or investment income, or you made estimated tax payments, you are entitled to have that withholding or estimated payments refunded. However, you must file a tax return to recover the withholding or tax payments.

2021 Recovery Rebate Credit – Individuals who didn't qualify for a third Economic Impact Payment or got less than the full amount, may be eligible to claim the 2021 recovery rebate credit . However, a 2021 return will need to be filed, even if not otherwise required to file a tax return. The credit will reduce any tax owed for 2021 or be included in the tax refund.

Earned Income Tax Credit (EITC) - A working individual who earned $57,414 or less in 2021 can receive the EITC as a tax refund. For 2021 the amount of the earned income credit ranges from $1,502 to $6,728 depending on your filing status and how many, if any, children you claim on your tax return. Those who did not file a return for tax year 2020 or 2021 or who did not claim the earned income tax credit on their 2020 or 2021 return because they had no earned income in those years may file an original or amended return to claim the credit using their 2019 earned income if they are otherwise eligible to do so.

Child Tax Credit Or Credit For Other Dependents – individuals can claim the child tax credit for 2021 if they have a qualifying child under the age of 18 and meet other qualifications. Other taxpayers may be eligible for the credit for other dependents. This includes people who have:

Dependents who are age 18 or older.

Dependents who have individual taxpayer identification numbers instead of a Social Security number.

Dependent parents or other qualifying relatives whom the taxpayer supports.

Dependents living with the taxpayer who aren't related to the taxpayer.

Education Credits – There are two higher education credits that can reduce the amount of tax someone owes on their tax return. One is the American opportunity tax credit and the other is the lifetime learning credit. The taxpayer, their spouse or their dependent must have been a student enrolled at least half time for one academic period and have paid college or university education expenses to qualify. The taxpayer may qualify for one of these credits even if they don't owe any taxes.

If you are not required to file, and didn’t, you can contact your local tax office to determine if any benefit can be gained by filing a 2021 tax return. Even if you are required to file and didn’t, they may be able to help you meet your filing requirements and take advantage of the many benefits available!

What Is a Required Minimum Distribution?

Required minimum distributions (RMDs) are required distributions from qualified retirement plans. RMDs are commonly associated with traditional IRAs, but they also apply to 401(k)s and SEP IRAs. The tax code does not allow taxpayers to keep funds in their qualified retirement plans indefinitely. Eventually, assets must be distributed, and taxes must be paid on those distributions. If a retirement plan owner takes no distributions, or if the distributions are not large enough, he or she may have to pay a 50% penalty on the amount that is not distributed. (Note that distributions are not required to be taken from Roth IRAs while the account owner is alive.)

Generally, RMDs begin in the year that the retirement plan owner attains the age of 72. The first year’s distribution can be delayed to no later than April 1 of the following year. However, delaying the first distribution means taking two distributions in the following year: one for the age-72 year and one for the next year. If an IRA owner dies after reaching age 72 but before April 1st of the next year, no minimum distribution is required because death occurred before the required beginning date. A person who turned 72 in a previous year is required to take the minimum distribution no later than December 31 of each year. The method for determining the minimum amount is explained below.

Even though the tax code mandates minimum distributions after reaching age 72, there is no maximum limit on distributions, and the retirement plan owner can withdraw as much as he or she wishes. However, if more than the required distribution is taken in a particular year, the excess cannot be applied toward the minimum required amounts for future years.

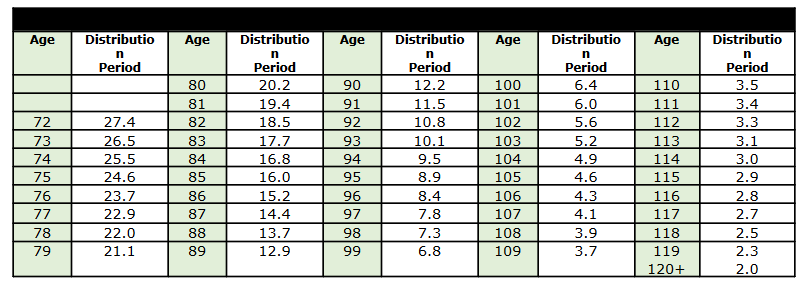

The required withdrawal amount for a given year is equal to the value of the retirement account on December 31 of the prior year divided by the distribution period from a table developed by the IRS. For individual's whose spouse is not the sole designated beneficiary, or, the individual's spouse is the sole designated beneficiary but is not more than 10 years younger than the individual, the Uniform Lifetime Table is used.

Retirement plan owners must calculate the RMD amount for each qualified retirement account separately. However, people who have more than one retirement account of the same type don’t have to take a separate RMD for each. They can aggregate and withdraw the entire amount from just one retirement plan of the same type or withdraw a portion from each plan to satisfy their RMD. So, for example, a distribution from a 401(k) plan won’t satisfy the distribution requirement from an IRA. Similarly, a Roth IRA distribution won’t count toward the RMD for a traditional IRA.

Two tables are not illustrated in this article because of their size: the Joint and Last Survivor Table, which is used to determine RMDs when the sole beneficiary is a spouse who is more than 10 years younger than the plan owner; and the Single Life Table, which is used for certain beneficiary RMD determinations. For table values that are not illustrated above, please call this office.

Example: An IRA account owner is age 75 in this tax year, and the value of his only IRA account was $120,000 on December 31 of last year. His 73-year-old wife is the sole beneficiary of the IRA. From the uniform lifetime table, we determine the owner’s distribution period to be 24.6. Thus, his RMD for the current year is $4,878 ($120,000/24.6). That amount must be withdrawn by no later than December 31 of the current year.

If, in the preceding example, the taxpayer did not withdraw the $4,878, he would be subject to a 50% penalty (additional tax) of $2,439 ($4,878 x 50%). Under certain circumstances, the IRS will waive the penalty if the taxpayer demonstrates reasonable cause and makes the withdrawal soon after discovering the shortfall in the distribution. However, the hassle and extra paperwork involved in asking the IRS to waive the penalty makes avoiding it highly desirable; to do so, always take the correct distribution in a timely manner. Some states also penalize under-distributions.

Even though a qualified plan owner whose total income is less than the return filing threshold is not required to file a tax return, he or she is still subject to the RMD rules and can thus be liable for the under-distribution penalty even if no income tax would have been due on the under-distribution.

BENEFICIARY REQUIRED DISTRIBUTIONS

There are special distribution requirements that apply to beneficiaries which they may be unaware of and that are often misunderstood. Not adhering to the beneficiary distribution requirements can lead to significant complications and penalties.

These beneficiary distributions include special rules for surviving spouse beneficiaries and another set of rules for others. These rules can be complex, and the following is a brief overview. You are cautioned to contact this office to determine how these rules apply to your specific situation. For simplicity, only IRAs are mentioned in the following explanations, but the provisions also apply to qualified retirement plans, such as 401(k)s.

Surviving Spouse – A surviving spouse beneficiary generally has the following options:

1. Treat their deceased spouse’s IRA as their own IRA by designating themself as the account owner.

2. Treat it as their own by rolling it over into their own IRA, or to the extent it is taxable, into a:

a. Qualified employer plan,

b. Qualified employee annuity plan (section 403(a) plan),

c. Tax-sheltered annuity plan (section 403(b) plan),

d. Deferred compensation plan of a state or local government (section 457 plan); or

3. Treat themself as the beneficiary rather than treating the IRA as their own.

Eligible Designated Beneficiaries - These beneficiaries are not subject to the rule (explained below) requiring the account be totally distributed in 10 years (except as noted) and may take lifetime distributions or a lump sum distribution. In addition to a surviving spouse, this category includes:

An individual who is not more than 10 years younger than the account owner (typically a sibling of the decedent but could be someone else).

Disabled or chronically ill individual:

A safe harbor for being considered disabled for this purpose is if the individual is determined to be disabled by the Social Security Administration.

To be eligible the individual must provide to the plan administrator proper documentation of their condition by October 31 of the year following the account owner’s death.

Account Owner’s Minor Child – The IRS has proposed regulations that specify that a minor child is one under the age of 21. Special rules apply to minor children of the account owner (would not apply to a grandchild):

Annual payments, using the single life ables, must be taken until the child reaches age 21.

Once reaching age 21, the child is then subject to the 10-year rule for the balance of the account.

Of course, the beneficiary can always take a lump sum distribution.

Other Beneficiaries – Can take a lump sum distribution or:

Beneficiaries more than 10 years younger than the decedent are subject to the 10-year rule.

Beneficiaries NOT more than 10 years younger than the decedent may take a lifetime payout.

Ten-Year Rule – While it’s true that the account must be depleted by the end of the year that includes the 10th anniversary of the account owner’s death, if the account owner died on or after their required beginning date (RBD), then the beneficiary must ALSO take annual distributions based their life expectancy and then distribute the balance in the 10th year.

PENDING LEGISLATION

There is legislation pending in Congress that would increase the required beginning date for RMDs. A bill in the House of Representatives would change the RBD from the current age 72 to 73 in 2023, 74 in 2030 and 75 in 2033. A Senate bill would change the RBD from 72 to 75, but not until calendar year 2032.

Please contact your tax office for assistance determining your RMD requirements and avoid potential penalties for not complying with those requirements.

How QuickBooks Online Tracks Products and Services

What products and services does your company sell? Do you have enough to fulfill existing and future orders? QuickBooks Online can tell you.

Most small businesses maintain a changing inventory of multiple products. Even if you sell one-of-a-kind goods, you need to know what you’ve sold and what’s available. And if your company sells services, you also have to keep track of what you’re able to offer customers.

QuickBooks Online can meet these needs. It allows you to create detailed records for both products and services. If you carry inventory, it can make sure that you always know what’s available to sell. When you enter sales and purchase transactions, the site draws on the records you’ve created to help you complete invoices, sales receipts, purchase orders, etc., without having to leave the form you’re working on.

Creating your records initially can take some time. And your products and services require regular monitoring and maintenance. But if you’re conscientious about these tasks, you’re not likely to run short on inventory or have too much money tied up in products that aren’t selling fast enough.

Preparing QuickBooks Online

Before you begin creating records and tracking inventory, you need to make sure that QuickBooks Online is set up correctly. Click the gear icon in the upper right. Under Your Company, click Account and settings. Click the Sales tab in the toolbar. You’ll see the Products and services section near the middle of the screen.

Make sure you’ve turned on the Products and services features you’re going to need.

Toggle the slider buttons on and off by clicking on them, and be sure to save your changes when you’re done. One option allows you to turn on price rules. This is still classified as a beta feature, but it’s live on the site. It’s also quite complicated to set up and can create confusion for your customers and revenue loss for you if it’s not done correctly. Let us help if you want to use this tool.

Creating Your Product and Service Records

Your first task, of course, is to build your product and service records. Hover your mouse over Sales in the left vertical toolbar on the home page and select Products and Services. The screen that opens is your home base for dealing with inventory and services. Eventually, it will contain a detailed table containing information about both. Two large buttons at the top of the page warn you when you have Low Stock or you’re Out of Stock.

Click New in the upper right corner. A vertical panel slides out from the right displaying your four options for Product/Service information. They are:

Inventory. If you buy and/or sell products whose quantities you must track, these items are considered inventory.

Non-inventory. You may have products that you buy and/or sell, but you don’t need to track the amount you have in stock. These are considered non-inventory.

Service. These are, well, services that you provide to customers, like landscaping or web design. You might sell these by the hour or project, for example.

Bundle. You might call these assemblies. Bundles are multiple products and/or services that you sell as a package for one price.

Click on Inventory for this example. Here is a partial view of the pane you’ll see:

You can track your inventory levels and reorder points when you create inventory product records in QuickBooks Online.

To create a product or service record, just fill in the blanks on the form and save it. Some fields are optional. In fact, only three are required: Name, Initial quantity on hand, and As of date. Of course, your inventory tracking and the use of product and service records in transactions and reports will be much more effective if you complete as many of the fields as possible. We recommend that you at least provide answers in some additional fields (some of which aren’t shown here), including:

Category (will be useful in reports, for example)

Reorder point (will keep you from running out of items)

Inventory asset account (you can leave the default, Inventory Asset)

Description (for sales forms)

Sales price/rate (what the customer will be charged)

Description (for purchase forms)

Cost (what you pay to buy it)

Expense account (often Cost of Good Sold, but you can ask us to be sure)

If you have other questions that would help you use QuickBooks more effectively, please reach out to your accountant or tax preparer!